Retirement Strategy

Based on your assumption rates & few details, get a detailed retirement strategy for required corpus, justification spreadsheet. You also get an option to plan with the nest-egg consumption or conservation mode.

What insurance policy or investment product we suggest is secondary.

What comes first

is Why the customer needs it.

Justify financial investments & suggestions by generating a simplified comprehensive

financial plan & address various life goals of the customer with some exciting calculators &

reports.

features

Here's what's under the hood of FinVine

Based on your assumption rates & few details, get a detailed retirement strategy for required corpus, justification spreadsheet. You also get an option to plan with the nest-egg consumption or conservation mode.

Get the future cost estimate in a detailed manner for each child's goal of SSC, HSC, Graduation, Masters & Marriage. What's more ?... You can choose to select individual goal of every child & strategize using various investment options.

Considering the assets, liabilities & funding provisions for kids & family survival, get a detailed report of required Life Insurance, Disability Cover & Health Insurance to mitigate his risk of liquidating assets during contingencies.

No matter how big the goal is, the investment decision is usually made within an agreed budget. Sometimes, the goal remains inadequately managed after we start off with small investment & dont increase it gradually. Budget planner helps the customer to stratify his savings & helps him meet his goals; within a fixed budget.

Though convinced, the customer sometimes gets into a delay mode & procrastinates his decisions. this calculator plays a pivotal role in explaining the loss he has made while delaying his investment decisions.

A famous thumbrule of 30:30:30:10 used by many financial planners & we have crafted it into a calculator to see if the financial pattern fits into this structure or not. Accordingly, various strategies can be implemented.

Most clients wait for longer term to get the maturity during the desired goal age. However, some of them always want to restrict their contribution term to a specific tenure. This calculator helps the advisor to restructure the contribution term to whatever requirements as the customer wants.

A simplified mix of 6 calculators... to calculate the maturity, required savings, required term, calculating yield & so on..

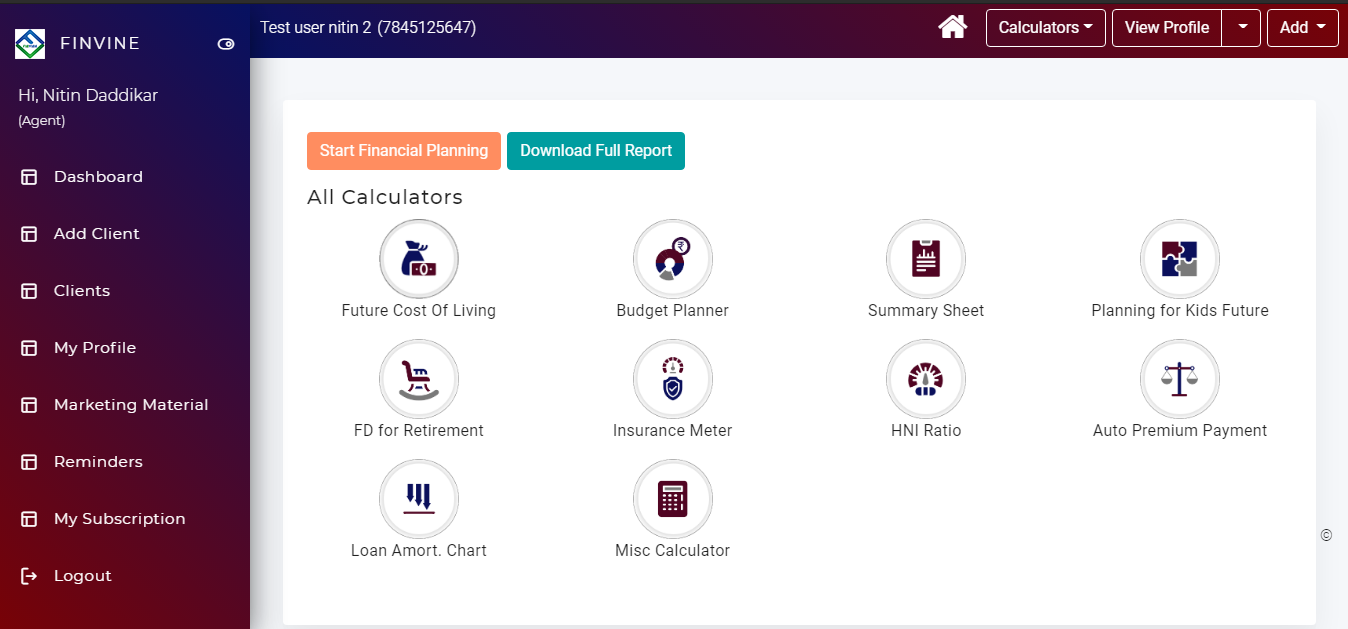

Our suggestion regarding Insurance Policy or Investment Product is something that comes later. The initial question that we need to address is "Why the customer needs it ?". Our product provides some exciting calculators & reports which will help our customers to Justify financial investments & suggestions by generating a simplified comprehensive financial plan & address various life goals.These exiciting calculators includes Retirement Strategy, Cost of Delay, Child Future Planning, HNI Ratio, Risk Management, Contribution Restructuring and so on, all in just one application. Along with that, all our calculators are updated with latest calculator formulas and trends. And we always try to make sure that your complicated financial plans and calculations are simplified in the best possible way .

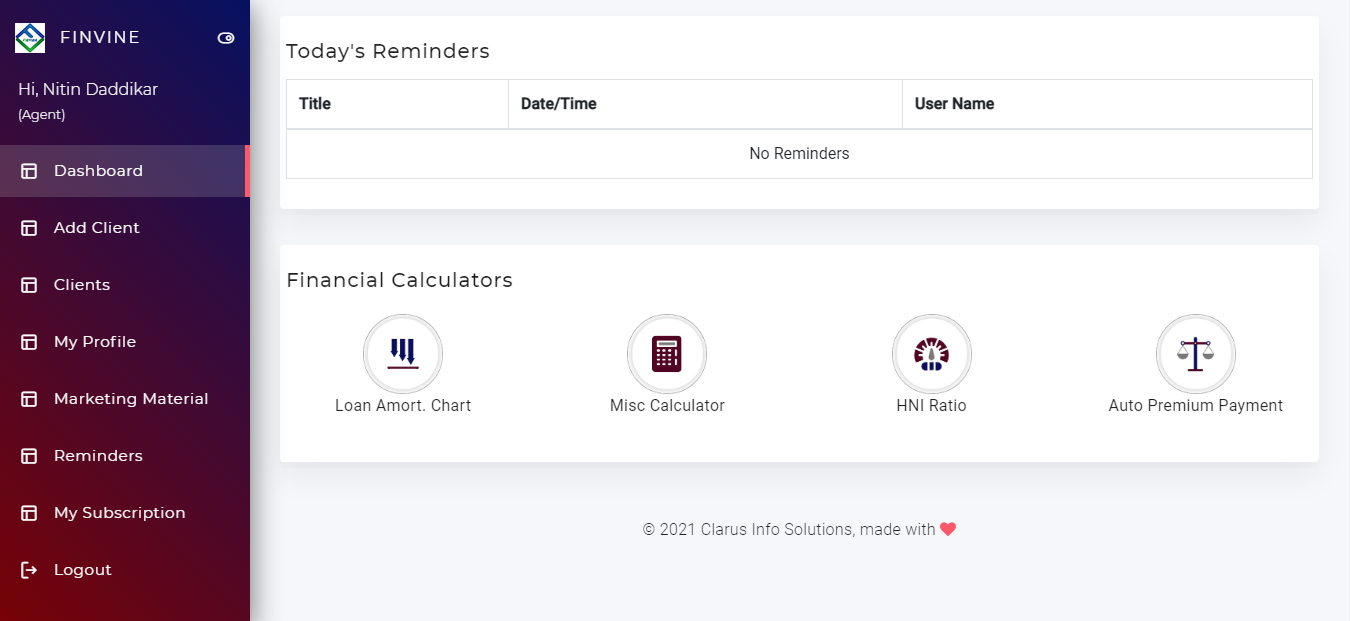

Finvine at a Glance

Finvine lets you keep track of all your plans in one place.

Get freedom from saving the data on pendrive/hard-disk... We do it for you on Cloud &

access it 24x7 worldwide.

Financial Planning Report

at a Glance

A detailed Comprehensive report covering the assumptions, requirements, provisions &

further strategies... You get everything in one place.

What's more, this report can be used as a best tool to generate repeat sales using its

Cumulative Rise in savings strategy.

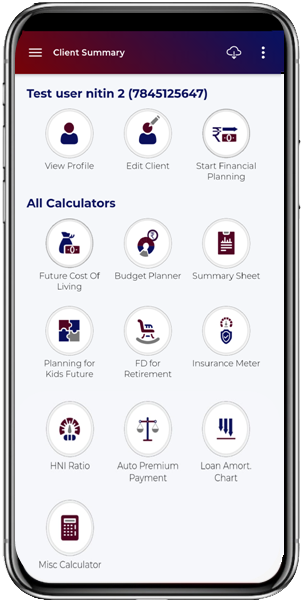

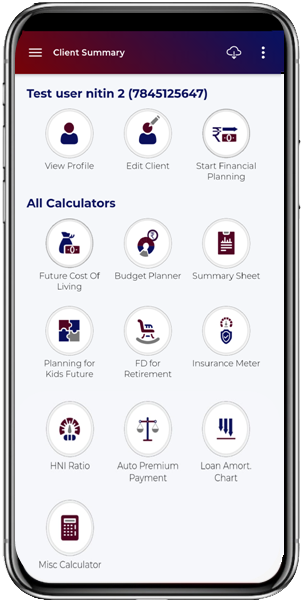

App Screenshots

Annual Billing

Appropriately implement one-to-one catalysts for change vis-a-vis wireless catalysts for change. Enthusiastically architect adaptive.

Address:

Swapna Siddhi Building

Akurli Cross Rd Number 2,

Kandivali, Govind Dalvi Nagar,

Kandivali East,

Mumbai, Maharashtra 400101

Contact:

Email:

Contact

Made With In India